boulder co sales tax 2020

Checklist for 2020 Commercial Energy Conservation Code Prescriptive Measures. View more property details sales history and Zestimate data on Zillow.

See reviews photos directions phone numbers and more for 2020 Tax Resolution locations in Boulder CO.

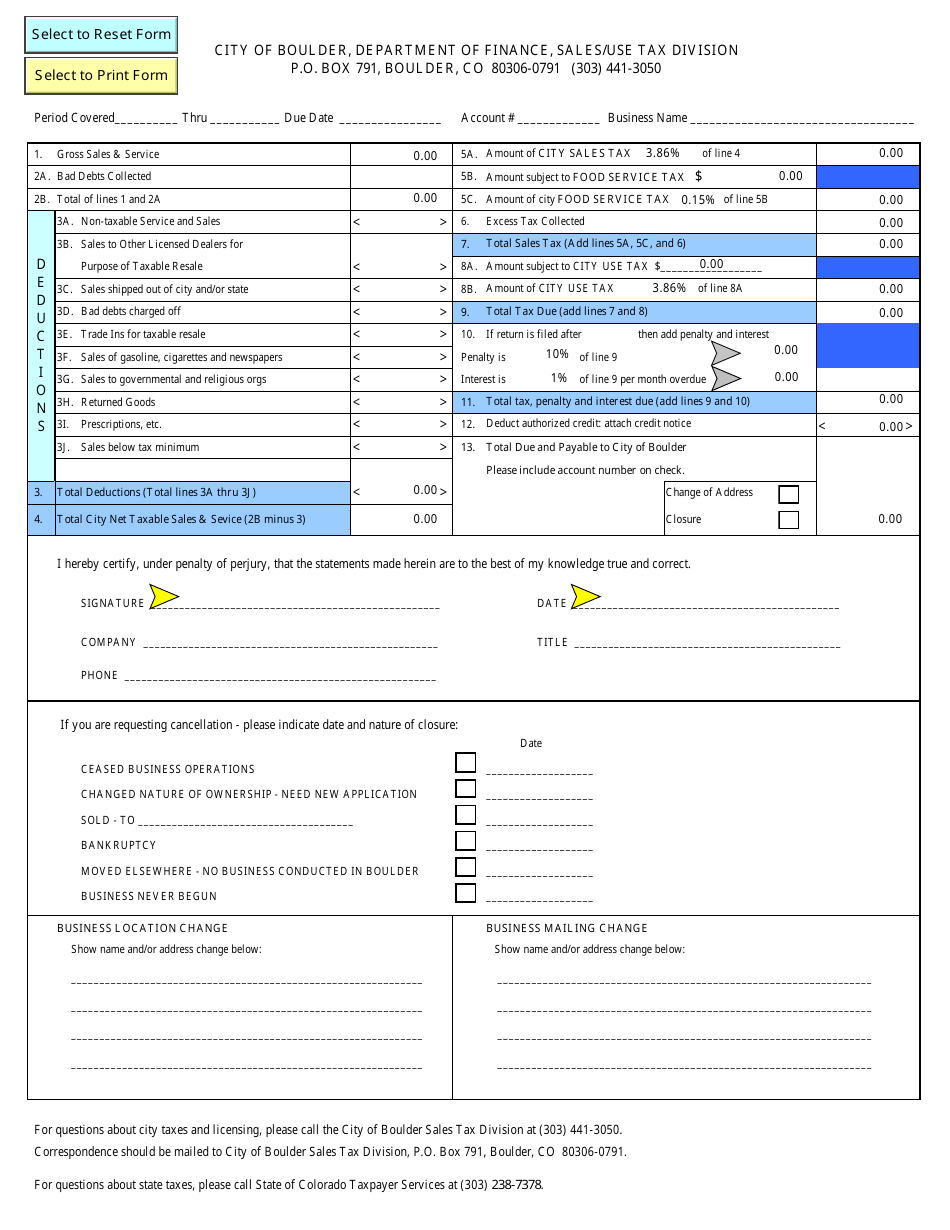

. Colorados general sales tax of 29 also applies to the purchase of beer. Colorado Department of Revenue Sales Tax Division 303-238-7378 Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax Boulder Countys Sales Tax Rate is 0985 for 2020. 2055 lower than the maximum sales tax in CO.

Microsoft Word - 2020 Sales Tax Rates 2nd Half Author. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501. Colorado Liquor Tax - 228 gallon.

June 30 2020 at 1159 pm. The Boulder County sales tax rate is. CO Sales Tax Rate.

As of July 1 2020 tobacco retailers must collect and remit the 40 sales tax on Electronic Smoking Devices including any refill cartridge or any other ESD components. For tax rates in other cities see Colorado sales taxes by city and county. The minimum combined 2022 sales tax rate for Boulder Colorado is.

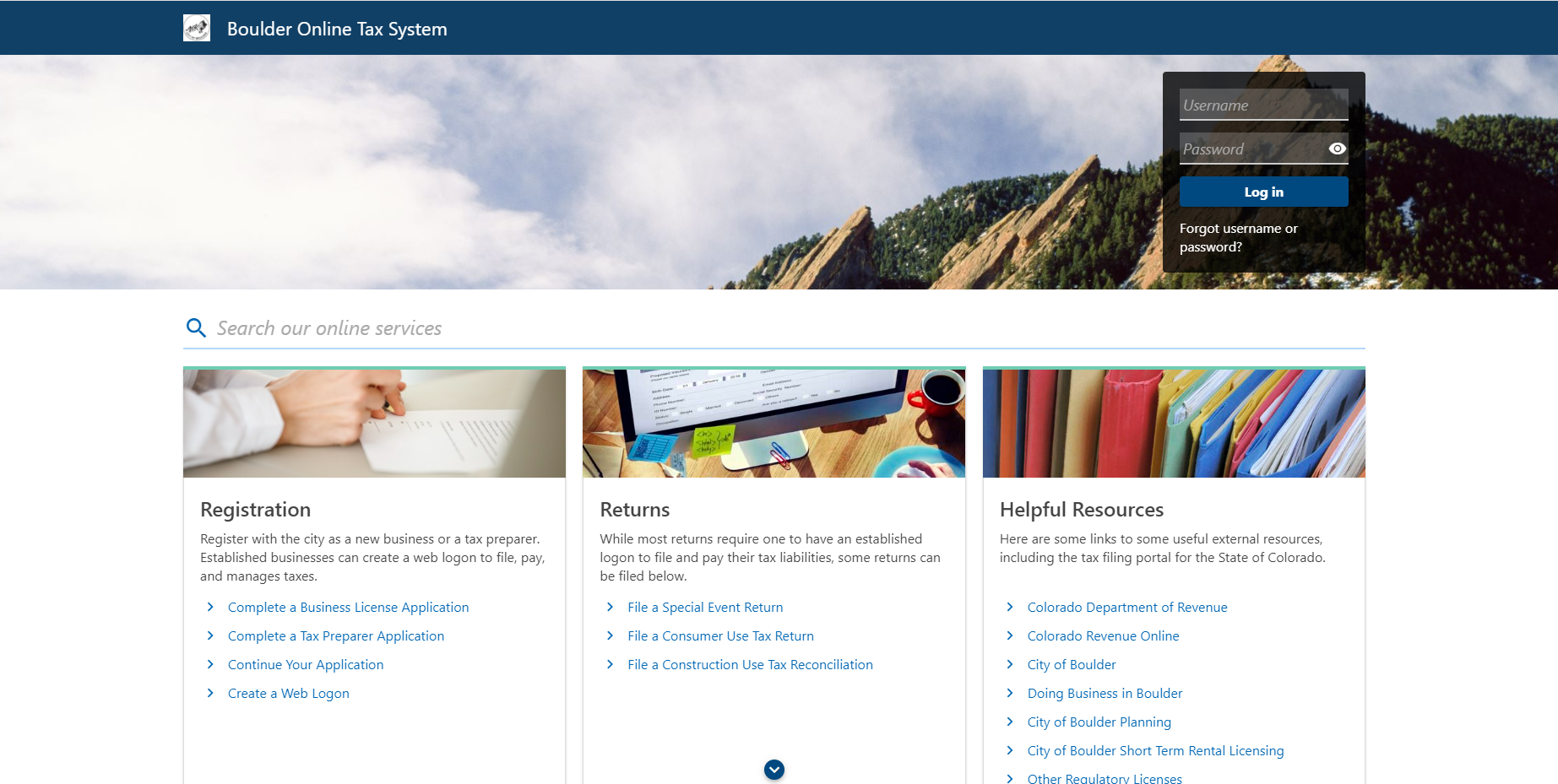

Boulders 40 Tax On Vaping Products Starts Wednesday. The December 2020 total local sales tax rate was also 4985. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions.

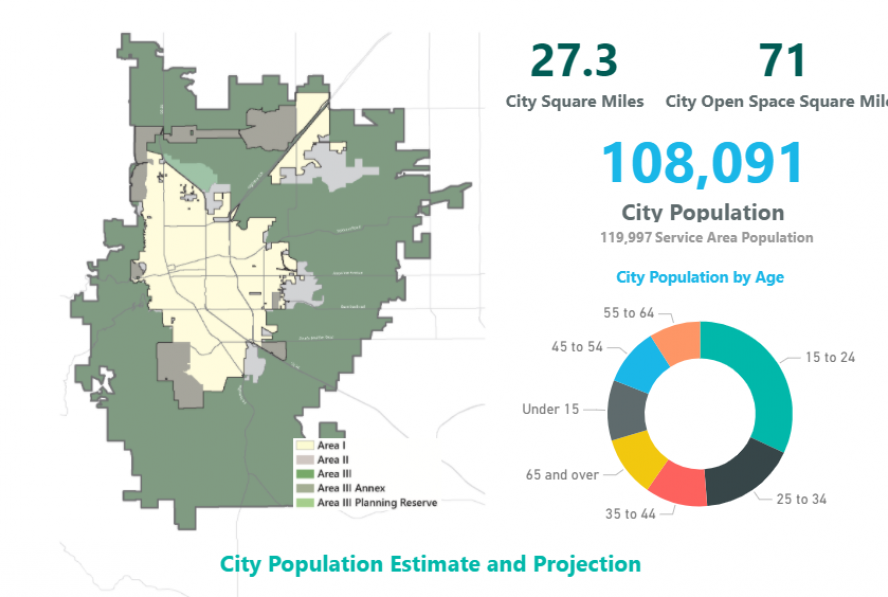

Colorado has a 29 sales tax and Boulder County collects an additional 0985 so the minimum sales tax rate in Boulder County is 3885 not including any city. The citys Sales Use Tax team manages business licensing sales tax use and other tax. The Colorado sales tax rate is currently.

Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. The 2018 United States Supreme Court decision in South Dakota v. About City of Boulders Sales and Use Tax.

6232020 10321 PM. Boulder Countys Sales Tax Rate is 0985 for 2020 Sales tax is due on all retail transactions in addition to any applicable city and state taxes. 1 PDF editor e-sign platform data collection form builder solution in a single app.

3497 Iris Ct Boulder CO 80304-1827 is currently not for sale. Has impacted many state nexus laws and sales tax collection requirements. Sales tax is due on all retail transactions in addition to any applicable city and state taxes.

This is the total of state and county sales tax rates. You can print a 8845 sales tax table here. Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont.

The 2020 Boulder County sales and use tax rate is 0985. The current total local sales tax rate in Boulder CO is 4985. The Boulder sales tax rate is.

The ESD tax is on top of the City of Boulder sales tax rate of 386. Boulder Countys Sales Tax Rate is 0985 for 2020. Single-family home is a 4 bed 40 bath property.

CBS4 Beginning Wednesday all vaping products sold in. Salestaxbouldercoloradogov o llamarnos a 303-441-4425. In Colorado beer vendors are responsible for paying a state excise tax of 008 per gallon plus Federal excise taxes for all beer sold.

Boulder County CO Sales Tax Rate The current total local sales tax rate in Boulder County CO is 4985. Single-family home is a 4 bed 40 bath property. The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs in conservaon transportaon offe nder management nonprofit capital.

Boulder County Niwot Lid. This is the total of state county and city sales tax rates. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax.

This home was built in 1988 and last sold on for. Para asistencia en español favor de mandarnos un email a. The December 2020 total local sales tax rate was 8845.

Boulder County does not issue licenses for sales tax as the county sales tax is collected by the Colorado Department of Revenue CDOR. Return the completed form in person 8-5 M-F or by mail. Boulder in Colorado has a tax rate of 885 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Boulder totaling 595.

County of Boulder 0985 Sales Tax Use tax on Building Materials and Motor Vehicles Open Space 0475 0125 ending 123134 010 ending. The Colorado state sales tax rate is currently. How to Apply for a Sales and Use Tax License.

Boulder Nissan is a new and used car dealer with sales service parts accessories and financing options. The County sales tax rate is. The minimum combined 2022 sales tax rate for Boulder County Colorado is.

Boulder co sales tax rate 2020 Sunday March 20 2022 Edit. ICalculator US Excellent Free Online Calculators for Personal and Business use. Tax Rates for Arizona - The Sales Tax Rate for Arizona is 81.

Short Term Dwelling And Vacation Rental Licensing Boulder County

Taxes In Boulder The State Of Colorado

Moving To Boulder Boulder Co Relocation Homebuyer Guide

Access To Land Boulder County Land Lease Program National Farmers Union

Innovation Technology City Of Boulder

Sales And Use Tax City Of Boulder

906 Arkansas Mountain Rd Boulder Co 80302 Realtor Com

601 Baseline Rd Boulder Co 80302 Realtor Com

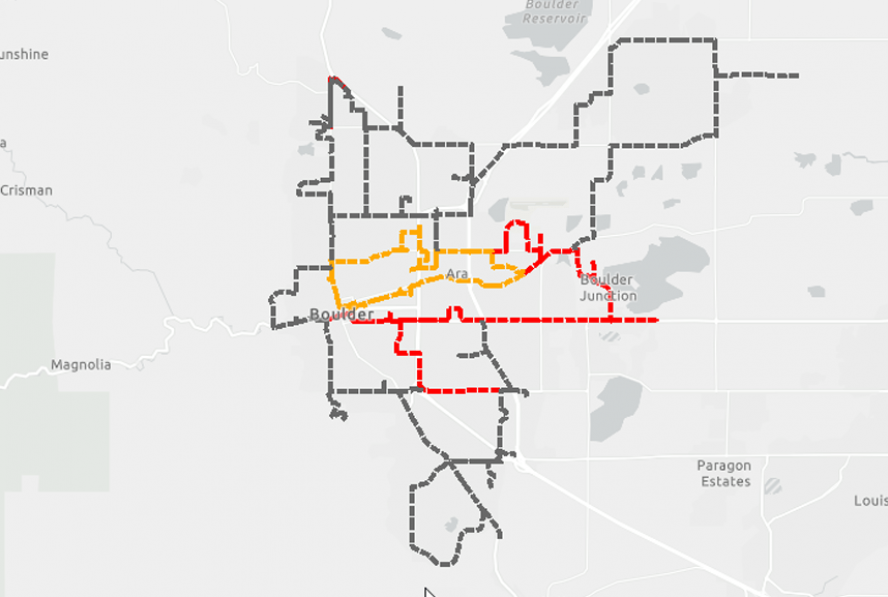

Boulder Exploring New Taxes Fees As Revenues Falter Boulder Beat

Construction Use Tax City Of Boulder

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

How Cu Boulder Is Funded Budget Fiscal Planning University Of Colorado Boulder

7679 34th Ct Boulder Co 4 Beds 3 5 Baths House Design Great Rooms Radiant Floor

1435 Sunset Blvd Boulder Co 80304 Realtor Com

Boulder Cost Of Living Boulder Co Living Expenses Guide

Innovation Technology City Of Boulder

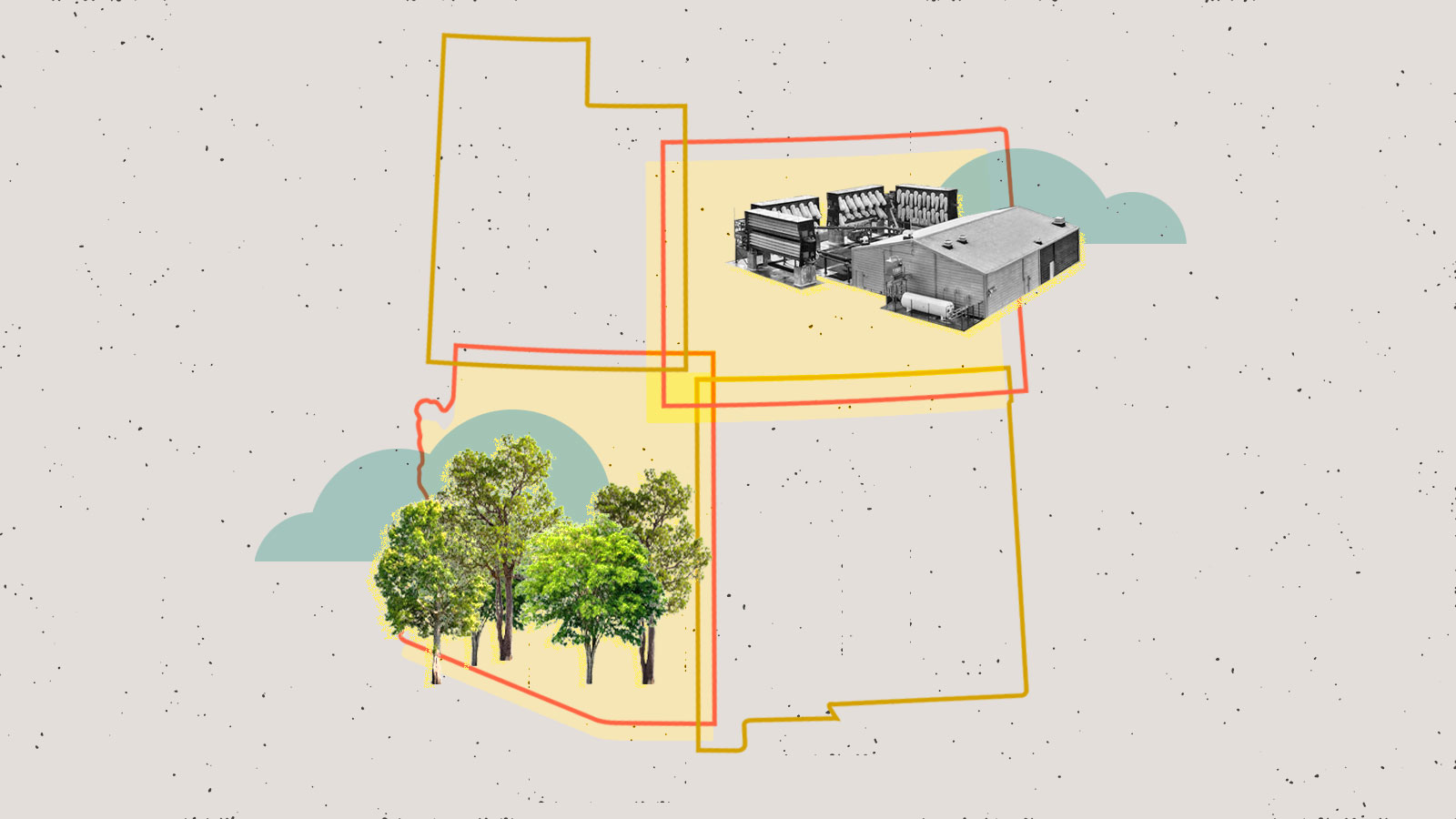

Why Boulder And Flagstaff Are Pooling Resources To Buy Carbon Removal Grist